Hey there!

Didn’t know you needed to be a mathematician to compare travel contracts? Don’t worry—it’s not rocket science, but the devil is in the details. The right contract isn’t just about the highest weekly rate; taxes, stipends, and housing costs can make a huge difference in your take-home pay. Let’s break it down to see which contract might be the most lucrative for you.

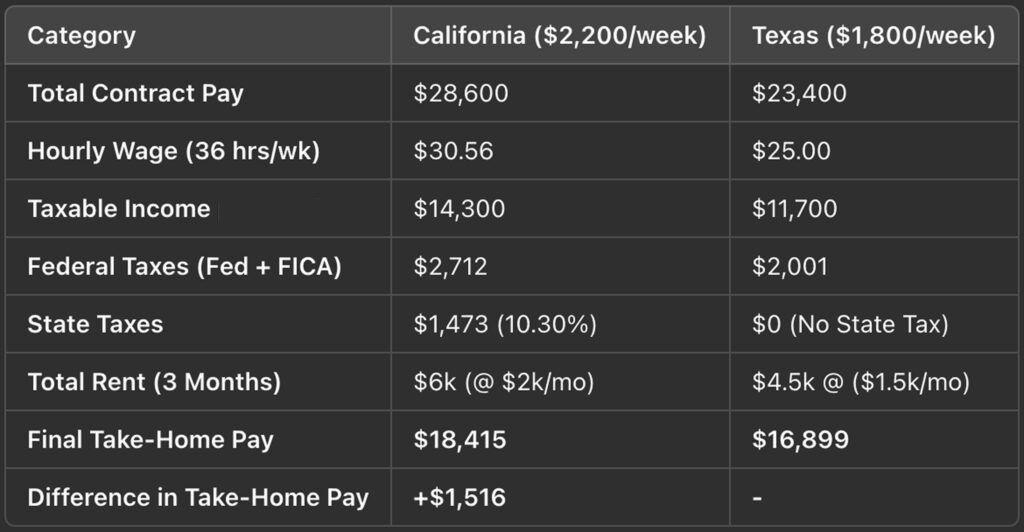

Imagine two contracts: One in California paying $2,200/week, and another in Texas paying $1,800/week—both with half as a tax-free stipend. California has higher state taxes and rent, while Texas has no state income tax but a lower weekly rate. Here’s how they compare over a 13-week contract:

In this scenario, the CA contract paid out almost $5,000 more over the course of the 13 week contract, but the take-home pay (after taxes and rent) was only $1,516 more. Keep in mind, these are all just examples, so you’ll want to run the real numbers yourself!

There are a ton of other variables too when comparing contracts. One stipend might be much different than the other. Flight costs could be different. Or, if the jobs are provided through different agencies, things like PTO, Day 1 insurance, and 401k plans can make a real difference (all of which you get with Stability).

Below I’ve included a list of each state’s estimated income taxes, “estimated” because some are progressive but this should be a good enough guide to help you assess a contract.

I hope this helps!

Zach Smith, BSN-RN

VP of Brand & Engagement

Stability Healthcare

FIND YOUR NEXT JOB

No State Income Tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

- New Hampshire (only taxes interest & dividends)

- Tennessee (phased out in 2021)

Flat Tax States:

- North Dakota: 1.10%

- Arizona: 2.50%

- Pennsylvania: 3.07%

- Indiana: 3.15%

- Ohio: 3.99%

- Michigan: 4.05%

- Colorado: 4.40%

- Kentucky: 4.50%

- North Carolina: 4.50%

- Illinois: 4.95%

- Missouri: 4.95%

Progressive Tax States:

- South Carolina: 0.00% – 7.00%

- Oklahoma: 0.25% – 4.75%

- California: 1.00% – 13.30%

- Georgia: 1.00% – 5.75%

- Idaho: 1.00% – 6.00%

- Montana: 1.00% – 6.75%

- North Dakota: 1.10% – 2.90%

- Hawaii: 1.40% – 11.00%

- New Jersey: 1.40% – 10.75%

- New Mexico: 1.70% – 5.90%

- Louisiana: 1.85% – 4.25%

- Alabama: 2.00% – 5.00%

- Arkansas: 2.00% – 4.90%

- Maryland: 2.00% – 5.75%

- Virginia: 2.00% – 5.75%

- Delaware: 2.20% – 6.60%

- Nebraska: 2.46% – 6.84%

- Connecticut: 3.00% – 6.99%

- West Virginia: 3.00% – 6.50%

- Kansas: 3.10% – 5.70%

- Vermont: 3.35% – 8.75%

- Wisconsin: 3.54% – 7.65%

- Rhode Island: 3.75% – 5.99%

- Mississippi: 4.00% – 5.00%

- New York: 4.00% – 10.90%

- Iowa: 4.40% – 6.00%

- Oregon: 4.75% – 9.90%

- Massachusetts: 5.00% – 9.00%

- Minnesota: 5.35% – 9.85%

- Maine: 5.80% – 7.15%